September 26, 2020

Depressed near one-week low under 0.7300

AUD/USD remains on the

back foot after posting the biggest losses in a month. The aussie pair

begins the key trading day, comprising the US employment data, while

keeping the recent 0.7265-82 range, currently around 0.7275, at the

start of Friday's Asian session. The pair's declines are mostly

attributed to the US dollar's sustained pullback from the multi-month

low, followed by a slump in the Wall Street benchmarks. Also weighing

the quote could be worried concerning the US stimulus and escalating

Sino-American tension.To get more news about WikiFX, you can visit wikifx official website.

After loosing +140 pips so far during September, AUD/USD questions

the bulls to reassess their bets. Though, the previous five-month rally

from the sub-0.6000 area terms the recent declines as a mere

consolidation than anything else.

Even so, market players need to be

cautious as the US Dollar Index (DXY) probes a three-week-old

resistance line following its U-turn from a 28-month low. The greenback

gauge respects the market's rush to risk-safety amid uncertainty over

the American stimulus and escalating US-China tension. Also favoring the

US currency could be the Fed policymakers' clears view of keeping the

monetary policy easy and without doubt, unlike others on the line that

still lack directions.

It's worth mentioning that the US Jobless Claims and the activity

numbers were also less harmful on Thursday. The same reversed fears of a

heavy disappointment from today's Nonfarm Payrolls (NFP) after

Wednesday's ADP data slipped below marked consensus of 950K to 428K.

Elsewhere, China's Global Times (GT) recently threatened the US to

cut its American debt holdings after the Trump administration announced

extra hardships for Beijing diplomats. One should know that China is the

world's second-largest holder of US debt.

Against this backdrop,

Wall Street benchmarks witness the sea of red led by the Nasdaq's 5.0%

losses and 1.5 basis points of the US 10-year Treasury yields.

Posted by: wisepowder at

05:29 AM

| No Comments

| Add Comment

Post contains 325 words, total size 3 kb.

Chance for USD/GBP/AUD Upside as JPY Strength Limited

Japanese

firms slashed spending on plant and equipment by the most in a decade in

the second quarter, the government said on Tuesday. As a result, the

strength of the Yen was limited while the USD/JPY staged a flat

performance and consolidated around 105.70.To get more news about WikiFX, you can visit wikifx official website.

"Abenomics†is much more likely to see an end ahead of the news that

Abe suddenly resigned his post, which put a premium on the Yen at once

but later revealed to be unrealistic for markets. As the core of

Abenomics, the Yens depreciation pushes domestic prices up and stimulate

the production of companies.

However, Japan's second-quarter

Capex falls most in decade, as reported on Tuesday. In addition, the

strength of JPY will be limited considering other challenges ahead of

Japan such as shrinking workforces and the indefinite postponement of

Olympic Games.

In terms of USD/JPY, the rate is expected to see a further growth

once finding the stability above the level of 104.00 in view of the

strong support ever achieved around the level.

In terms of

EUR/JPY, the rate is now stay in the ascending channel but may hit the

resistance zone of 129.0-130.0 in future tradings if the support is

continuously gained at the lower band of 125.0.

The exchange rate

of AUD/JPY shows a more complex picture. Its short-term uptrend is

expected to suffer a setback as it is currently approaching the

resistance level of 78.60. While in the medium term, gains will be

extended in future tradings if it stays constructive below the 76.60

level.

All the above is provided by WikiFX, a platform

world-renowned for foreign exchange information. For details, please

download the WikiFX App: bit.ly/WIKIFX

Posted by: wisepowder at

05:20 AM

| No Comments

| Add Comment

Post contains 303 words, total size 3 kb.

A Visit to Forex Broker BP Prime in London

An investor lately

asked WikiFX to verify the regulatory information and business

conditions of the British broker BP Prime. In response to the trader,

WikiFX decided to visit the broker BP Prime in London.To get more news

about WikiFX, you can visit wikifx official website.

Broker introduction

BP Prime was founded in 2013. Headquartered in London, it has offices

in Italy and China with clients across Europe, Asia and South America,

providing contracts for difference of forex, commodities and crypto

currencies.

Great Eastern Street, where is only 20 minutes away from the central

London, has become commercialized to a great extent. Along the way, it

was found that the entire street has bristled with high-grade office

buildings. The investigator arrived at the building numbered 62 under

the help of navigation. Does BP Prime really work here?

Entering

the building, the investigator noticed that all the entrance, reception

and floors have been refurbished. The building was accessible only by

swiping its card and there were security guards around. With advance

reservation, the investigator was soon received by the staff of BP Prime

After getting into its office, the investigator observed that many

employees were orderly working on computers, with various documents

neatly stacked next to them. The overall environment was clean and

comfortable as the office was also equipped with a rest area and a

tearoom.

This visit confirms that the broker BP Prime is a real

one and its business address is in line with that on the regulatory

information. On the WikiFX APP, BP Prime has been rated 6.86. It is

currently under valid supervision with the Straight-Through-Processing

(STP) license of the FCA.

Posted by: wisepowder at

05:11 AM

| No Comments

| Add Comment

Post contains 292 words, total size 3 kb.

Tumbling WTI Concerns for $41.30

WTI crude reported the largest

one-day fall in three months on Wednesday, bottoming at $41.23 from the

high level of $43.20. Oil prices have rebounded back overnight after

breaching below the key support of $41.30, and are consolidating above

$41.30 now.To get more news about WikiFX, you can visit wikifx official website.

The rally of the U.S. dollar index will become one of the important

factors affecting oil prices. Meanwhile, the ADP said on Wednesday that

the U.S. economy added 428,000 jobs in August. As the third largest

increase of all time, it indicates that the U.S. economy is generally

optimistic in the month.

Accounting for three-quarters of the U.S. economy, the service sector

will embrace its data for August today, including the Markit's final

reading of the Services PMI and the ISM non-manufacturing PMI. In

addition, the non-farm payrolls for August will be published tomorrow.

The overall markets, including the crude oil markets, are expected to

suffer wild swings due to the data.

On the other hand, the EIA

reported that the country's production of crude oil has reached a record

low for the week ending August 28. At the same time, oil prices may be

hampered as the market expectations that refineries will soon be shut

down for equipment maintenance may further weaken the demand for oil and

gasoline.

According to the daily chart, oil prices are

consolidating around the level of $41.30 and expected to further test

this key support in the short term, where a breach below may extend

downside to $34.50 in the medium term. However, if oil prices stay

constructive above the level, there is room for upside to challenge the

resistance zone of $44.0-45.0.

All the above is provided by

WikiFX, a platform world-renowned for foreign exchange information. For

details, please download the WikiFX App: bit.ly/WIKIFX

Posted by: wisepowder at

05:03 AM

| No Comments

| Add Comment

Post contains 313 words, total size 3 kb.

PM Modi pitches India as best place for global investors

Prime

Minister Narendra Modi on Thursday said the country's political

stability and policy continuity makes it the best place for global

investors in the aftermath of the COVID-19 pandemic.To get more news

about WikiFX, you can visit wikifx official website.

Addressing the US-India Strategic Partnership Forum through video

confence, Modi also cited a slew of reforms undertaken by his government

and asserted that India is committed to democracy and diversity and it

has undertaken far-reaching reforms in recent months.

Noting that the current situation demands a fresh mindset that is

human-centric, Modi said India did the same by scaling up its healthcare

facilities in a record time to deal with the COVID-19 pandemic.

He also said India was amongst the first globally to advocate masks

and face coverings as a public health measure and also amongst those

creating a public campaign about social distancing. Modi further said

his government has undertaken far-reaching reforms to make the business

easier and red-tapism lesser.

Modi said his government launched

one of the largest support programmes for the poor globally following

the COVID-19 outbreak in form of the Pradhan Mantri Garib Kalyan Yojna,

under which free foodgrains have been provided to over 80 crore people.

Posted by: wisepowder at

04:56 AM

| No Comments

| Add Comment

Post contains 221 words, total size 2 kb.

Silver Lake in talks to take $1 billion stake in India's Reliance Retail

Private

equity firm Silver Lake Partners SILAK.UL is in talks to invest $1

billion in the retail arm of India's Reliance Industries Ltd.To get more

news about WikiFX, you can visit wikifx official website.

The investment, which would value Reliance Retail at about $57

billion, comes as the company is aiming to sell about 10% in new shares,

the report added.

Silver Lake declined to comment on the report,

while Reliance could not immediately be reached outside of normal

business hours.

Reliance, an oil-to-telecoms conglomerate controlled by India's richest

man, Mukesh Ambani, is pitching its retail business as a formidable

force in the world's second most populous country, expanding rapidly to

woo potential investors. company has raised more than $20 billion from

global investors including Facebook Inc by selling stakes in its Jio

Platforms digital business and has said it aims to attract investors to

Reliance Retail over the next few quarters.

In late August,

Reliance said it would acquire the retail and logistics businesses of

India's Future Group in a deal valued at $3.38 billion, including debt.

The dollar extended gains on Wednesday and the euro fell, retreating from the key $1.20 level reached in the previous session.

Wednesday's counter-trend was attributed by analysts to profit taking

and technical resistance to the $1.20 mark hit Tuesday, spurred on by

comments from European Central Bank chief economist Philip Lane, who

said that the euro-dollar rate "does matter†for monetary policy.

Comments show the ECB was rattled by the appreciation of the euro and

fall in the dollar.

Posted by: wisepowder at

04:48 AM

| No Comments

| Add Comment

Post contains 283 words, total size 2 kb.

Oil May Decline on Plunging Wall Street & Soaring VIX

On

Thursday, the Wall Street saw a sharp drop ahead of the upcoming

non-farm payrolls; The fear index (VIX), a popular measure of the stock

market's expectation of volatility, largely rallied to an intraday high

of 35.94% from 25.66%; WTI crude further penetrated the level of $41.30

to an intraday low of $40.22.To get more news about WikiFX, you can visit wikifx official website.

As the FED Chair Powell has repeatedly emphasized the importance of

labor data earlier, bulls took profits before the release of non-farm

payrolls, which punished U.S. stocks after fresh highs in a row.

On the other hand, Markit announced yesterday that its final reading

of the Services PMI was 55, indicating the U.S. economy is regaining

energy. However, such recovery occurs in an imbalance way as the

activities of consumer-oriented sectors are still falling steadily due

to the continuous practice of social distancing.

Moreover, the

uncertainty in Sino-U.S. trade also curbs markets' bullish outlook. The

Wall Street may see its short-term loss deepened in future tradings, and

the downside may be steep if the upcoming non-farm payrolls prove to be

poor.

WTI is struggling around the level of $41.30 and may further test the

support here in the short run, while a breach below the level may bring

$34.50 on the radar in the medium run. The factor that most limits oil

prices is the sluggish revival of demand due to the uncertainty in

global economic recovery. Consequently, oil prices are expected to be

weak before the good news about vaccines being more specific.

All

the above is provided by WikiFX, a platform world-renowned for foreign

exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Posted by: wisepowder at

04:41 AM

| No Comments

| Add Comment

Post contains 300 words, total size 3 kb.

3D Rendering Services Market to Reach

Allied Market Research

published a report, titled, "3D Rendering Services Market by Service

Type (Interior Visualization, Exterior Visualization, Modeling Services,

Walkthrough & Animation, and Floor Plan), End User (Architects,

Designers, Engineering Firms, and Real Estate Companies), and Project

Type (Commercial Project and Residential Projects): Global Opportunity

Analysis and Industry Forecast, 2019–2026." According to the report, the

global 3D rendering services market garnered $8.56 billion in 2018, and

expected to generate $61.65 billion by 2026, registering a CAGR of

28.1% from 2019 to 2026.To get more news about design rendering

services, you can visit https://www.madpainter.net official website.

Increase in requirement for virtualized & real-time experience in

designing and planning along with rise in demand for real-time rendering

and rapid decision-making capabilities drive the growth of the global

3D rendering services market. However, lack of skilled professionals and

security & privacy concerns hinder the market growth. On the other

hand, surge in implementation of cloud-based 3D rendering services offer

numerous opportunities in coming years.

Based on project type, the residential segment is expected to grow at the highest CAGR of 29.1% from 2019 to 2026. This is attributed to rise in real-time rendering to acquire photorealistic results of the building and increase in demand for quality 3D images. However, the commercial segment held the largest market share in 2018, accounting for more than two-thirds of the global 3D rendering services market, and is expected to maintain its leadership status during the forecast period.

Based on end users, the architects' segment contributed to the highest market share in 2018, contributing to more than one-fifth of the global 3D rendering services market, and is expected to maintain its dominance by 2026. This is attributed to numerous applications such as 3D architectural visualization that has been utilized by architects to visualize the architectural structure before its real-world construction. However, the designers' segment is expected to register the fastest CAGR of 39.0% during the forecast period, owing to the adoption of cloud-based 3D rendering designer services across the globe.

Based on region, North America accounted for the major market share, accounting for nearly two-fifths of the total market share of the global 3D rendering services market in 2018, and is projected to maintain its highest contribution during the forecast period. This is attributed to rise in the construction of residential projects and government initiatives supporting the projects in this region. However, the Asia-Pacific region is estimated to grow at a CAGR of 30.1% from 2019 to 2026. This is due to rapid urbanization and industrialization in emerging countries such as India and China.

Avenue is a user-based library of global market report database, provides comprehensive reports pertaining to the world's largest emerging markets. It further offers e-access to all the available industry reports just in a jiffy. By offering core business insights on the varied industries, economies, and end users worldwide, Avenue ensures that the registered members get an easy as well as single gateway to their all-inclusive requirements.

Posted by: wisepowder at

04:31 AM

| No Comments

| Add Comment

Post contains 505 words, total size 4 kb.

3D Rendering Market COVID-19 Impact Assessment

Pune, Maharashtra, June 20, 2020 (Wired Release) Prudour Pvt. Ltd: Market.us research industry gives a complete investigation of the global 3D Rendering market for the predicted forecast period 2020-2029. The 3D Rendering market research study delivers deep insights into the various market segments based on end-use, types, and geography. The latest 3D Rendering report covers the current COVID-19 impact on the market features, volume and growth, segmentation, geographical and country categorizations, competitive landscape, trends, and plans for this market. The pandemic of Coronavirus (COVID-19) has influenced every perspective of life globally. The report provides a basic introduction of the industry 3d rendering including its definition, applications, and manufacturing technology. The analysis report on the 3d rendering market includes both qualitative as well as quantitative details that exclusively concentrating on the different parameters such as 3d rendering market risk factors, difficulties, technical developments, new opportunities available in 3d rendering report.To get more news about design rendering services, you can visit https://www.3drenderingltd.com official website.

The worldwide market that compares to the 3d rendering market size, market share, increase factor, key vendors, revenue, product demand, sales size, quantity, cost structure, and development in the 3d rendering Market. The goal of this report is to include historical, present, and coming trends for 3d rendering supply, market volume, prices, trading, competition, and value chain. The market report documents all global important business players joined with their company profiles, size, product value, product specifications, capability. It provides a comprehensive analysis of key features of the global 3d rendering market .3D Rendering market report will be taken as an essential guide for the users so that they can clearly understand each and every factor related to the 3d rendering market. It concentrates on the examination of the current market and forthcoming innovations, to provide better insights for the businesses.

Market.US specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons. We offer tactical and strategic support, which enables our esteemed clients to make well-informed business decisions and chart out future plans and attain success every single time. Besides analysis and scenarios, we provide insights into global, regional, and country-level information and data, to ensure nothing remains hidden in any target market. Our team of tried and tested individuals continues to break barriers in the field of market research as we forge forward with a new and ever-expanding focus on emerging markets.

Posted by: wisepowder at

04:17 AM

| No Comments

| Add Comment

Post contains 462 words, total size 3 kb.

September 25, 2020

Gold Swings with Enduring Buoyancy

Gold prices are sustaining the consolidation now, but may see a wedge/triangle pattern this month.To get more news about WikiFX, you can visit wikifx official website.

The FED Governor Lael Brainard stressed that a flexible average

inflation targeting means the inflation may be achieved moderately above

2% for a time, indicating that gold may be more attractive as the

Federal Open Market Committee (FOMC) may stick to the status quo at the

monetary policy meeting on September .

At the same time, markets

may continue the current trends with bulls for the U.S. dollar

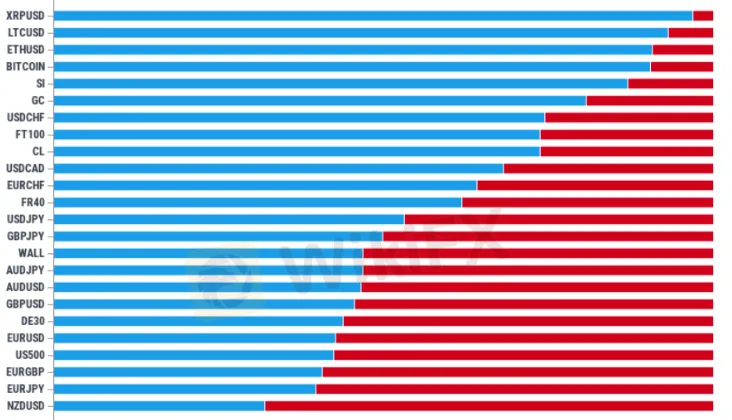

increasing in this month. According to the IG Client Sentiment report,

retail traders hold net-long USD/CHF, USD/CAD and USD/JPY, while the

crowd remains net-short AUD/USD, NZD/USD, EUR/USD and GBP/USD. The

ongoing tilt in retail sentiment may continue to coincide with the

bullish behavior in gold as the dollar index is verging below the key

support zone.

The Relative Strength Index (RSI) requires close attention as it

appears to have bottomed out in August. However, the bullish outlook

will only greet it when both a breach above 70 and a overbought

territory are achieved. This indicator may help to validate the

wedge/triangle formation.

Until then, gold prices may continue to

face range bound conditions. In future tradings, a closing price above

the Fibonacci overlap of $1,971-1,985 is necessary for bringing the

$2025 region back on the radar.

All the above is provided by

WikiFX, a platform world-renowned for foreign exchange information. For

details, please download the WikiFX App:

Posted by: wisepowder at

04:43 AM

| No Comments

| Add Comment

Post contains 261 words, total size 2 kb.

Oil drops more than $1 after Saudi price cuts, demand optimism fades

Oil

prices dropped more than $1 a barrel on Monday, hitting their lowest

since July, after Saudi Arabia made the deepest monthly price cuts for

supply to Asia in five months as optimism about demand recovery cooled

amid the coronavirus pandemic.To get more news about WikiFX, you can visit wikifx official website.

Brent crude LCOc1 was at $41.75 a barrel, down 91 cents or 2.1% by

0000 GMT, after it earlier slid to $41.51, its lowest since July 30.

U.S. West Texas Intermediate crude CLc1 skidded 91 cents, or 2.3%, to

$38.86 a barrel. Front-month prices initially hit a low of $38.55 a

barrel, a level not seen since July 10.

The world remained awash

with crude and fuel supplies despite OPEC+ supply cuts and government

efforts to stimulate the global economy and oil demand, forcing refiners

to rein in output and producers to make deep price cuts again.

"With the Labour Day (holiday) in the U.S. officially marking the end

of the summer driving season, investors are also facing up to the fact

that demand has been lacklustre, while inventories remain at elevated

levels,†ANZ analysts said in a note.

The world‘s top oil exporter

Saudi Arabia cut the October official selling price for Arab Light

crude it sells to Asia by the biggest margin since May. Asia is Saudi

Arabia’s largest market by region.

Posted by: wisepowder at

04:37 AM

| No Comments

| Add Comment

Post contains 250 words, total size 2 kb.

Oil Market Expected to be Worse Because of Dropping in US Stock and Oil

the

US stock index and yields have reported to bounce off recently after

the release of the US non-farm payrolls report, or NFP, in August, with

the index rising to an intraday high level of 93.24, hitting a week

high; WIT crude oil falling to an intraday low level of 39.35 dollars,

recording a month low.To get more news about WikiFX, you can visit wikifx official website.

The NFP in August showed that jobs increased by 1.371 million and

unemployment rate decreased by 8.4%. Although it revealed an optimistic

market, the working population, objectively speaking, presents a sign of

slowdown. In addition, the permanent unemployment rose to 3.4 million.

Therefore, there are great uncertainties about the recovery in the US

economy.

According to the performance of US stock on Sept. 4th, it

is obvious that the US stock wasnt stronger for benefiting from the NFP

and three benchmark indexes generally dropped. It is expected that the

oil may encounter further the sustained selling pressure from the US

stock.

This Saturday will see the interest rate decision in September by the

European Central Bank (ECB). Considering the worse European coronavirus

situation, the ECB warned last week that the euro depreciated fast. The

more easing signals by the ECB may put pressure on the euro, strengthen

the US stock index and drive further downside in the gold price.

Moreover, the adds are that the oil demand becomes worse during the

upcoming seasonal shutdown maintenance of oil refineries. The oil price,

so far, has fallen below the level of 40 dollars, and is expected to be

confronted with selling pressure if it cannot break upward the level of

41.3 dollars in the near term.

All the above is provided by

WikiFX, a platform world-renowned for foreign exchange information. For

details, please download the WikiFX App: bit.ly/WIKIFX

Posted by: wisepowder at

04:30 AM

| No Comments

| Add Comment

Post contains 331 words, total size 3 kb.

Paytm Money Aims To Be India’s Top Wealth Manager

Paytm Money,

the online platform for mutual fund investments that recently forayed

into equity broking, aims to be India‘s top wealth manager as the owner

of the nation’s largest e-wallet expands its financial services

footprint.To get more news about WikiFX, you can visit wikifx official website.

"As we progress in this journey of becoming the preferred platform

for users to save and invest, our goal is to provide a simple platform

for users to do so,†Varun Sridhar, chief executive officer at digital

investment unit of One97 Communications Pvt., told BloombergQuint in an

interview. "With a few clicks you are able to save and make your money

work harder.â€

Paytm Money, which has 200-300 million customers doing 20-30 million

transactions daily, aims to capitalise on its existing user base. "We

see about 80%-odd users who are, what Id call, important or very loyal

Paytm users, and about 20% come from outside the system.â€

Posted by: wisepowder at

04:21 AM

| No Comments

| Add Comment

Post contains 171 words, total size 2 kb.

Top Architectural 3D Rendering Companies to Consider in 2020

Architectural 3D rendering has come a long way over the past couple decades. Rendering companies are expanding upon industry-standard, hyper-realistic visualizations with new services like simulated environments that let prospective clients virtually experience your architecture first hand. Furthermore, these beautiful representations can be mocked up and created to visualize the proof-of-concept with a quick turnaround. And with technology advancing, these kinds of solutions are in exceptionally high demand. Keep reading to see our selected list of some of the best and brightest stars in the architectural 3D rendering industry.To get more news about design rendering services, you can visit https://www.3drenderingltd.com official website.

Based out of Lanarkshire, Scotland, Archicgi is touted as the very best rendering company that the United Kingdom has to offer. Specializing in architectural visualization and presentation with beautiful lighting, composition, and photorealism, services include interior and exterior imagery as well as virtual staging and animation.

The rendering

company is so confident that they can deliver your project on time to

your exact specifications that they even provide unlimited revisions and

a 100% delivery guarantee or your money back. Check out Archicgi’s

gorgeous portfolio or request a price guide with example case studies

for a better idea of what is included with each service.

With dual

headquarters in Budapest and Romania — but partnered with studios like

Gensler and Nordic — Brick Visual are self-described storytellers,

offering a comprehensive background in giving a voice to clients by

communicating their architectural and design visions.

Along with rendering, Brick Visual also offers drone photography and architectural planning, as well as virtual reality and augmented reality solutions that transform each visualization into an experience. This is done by providing state-of-the-art 3D rendering services without pigeonholing themselves into one particular style. While the company is very confident in its craft, its design team will do whatever it takes to deliver the product the client is looking for.

Posted by: wisepowder at

04:04 AM

| No Comments

| Add Comment

Post contains 333 words, total size 3 kb.

September 24, 2020

​Oil Sees Struggling Uptrend Despite Price Gains

As of early

this morning (GMT+![]() , WTI ended higher 1.95% with oil prices increasing

in the wake of the meeting of the OPEC+ Joint Ministerial Monitoring

Committee (JMMC), which was held on the night of September 17.To get

more news about WikiFX, you can visit wikifx official website.

, WTI ended higher 1.95% with oil prices increasing

in the wake of the meeting of the OPEC+ Joint Ministerial Monitoring

Committee (JMMC), which was held on the night of September 17.To get

more news about WikiFX, you can visit wikifx official website.

At the meeting, the OPEC+ committed to fully comply with the

production cut agreement and urge the "cheating countries†to compensate

for overproduced barrels. As the compensation may last till the end of

the year, market stability will be further promoted. The OPEC+ also

pledged to "actively†adjust the cuts quota of 2021 when necessary, so

as to deter speculation on crude oil.

Oil prices jumped by 1.95%

after the meeting and have bounced back above 200-DMA, which may be a

technical progress uplifting oil bulls.

As far as the trend this

month, oil prices are still edging down and may struggle to extend its

rebound ahead of the critical zone of technical resistance around the

$41.00. A back-test of the 50-DMA could keep a lid on further advances

attempted by the commodity.

All the above is provided by WikiFX, a platform world-renowned for

foreign exchange information. For details, please download the WikiFX

App:

Posted by: wisepowder at

02:40 AM

| No Comments

| Add Comment

Post contains 216 words, total size 2 kb.

Three Things Dominating Forex Markets

First of all, will technology stocks continue correcting? The Nasdaq composite has remained in correction since hitting a record high on September 2. As of September 11, the index has retraced by over 10% from its highs. The reason for the sustained decline is rumored to be Masayoshi Son, the richest person in Japan, whos position was squeezed after trading options. Whether or not the statement is right, it is normal for Nasdaq to see correction when accumulating large gains. Therefore, the correction is expected to continue until finding its initial support at 10,180. In this case, the U.S. dollar index may keep climbing this week.To get more news about WikiFX, you can visit wikifx official website.

Secondly, the British Parliament conducted the second reading debate on Johnson's Internal Market Bill on September 14. The bill may put the UK in the risk of no-deal Brexit, spurring more selling of the pound. I hold a pessimistic view that the UK is probably to stage a hard Brexit. This is mainly because the country's breach of the agreement, through which it hopes to force the EU to make concessions, will instead push the EU to fight every inch of the way. As the EU has declared it would accuse the UK of violating international law, the two parties can hardly reach a consensus in the face of such differences and trends. The dilemma is difficult to resolve unless Conservative MPs of the British Parliament dramatically change their sides, thus the pound is almost certain to see a deep loss.

The third thing is the leadership election of the Liberal Democratic

Party of Japan on September 14. Unless something unexpected happens,

Yoshihide Suga is set to win the election and the Abenomics policy will

be maintained, not surprisingly, as he repeatedly stressed. One key

unknown is whether Suga will call a snap general election soon after

taking office, which will thrust the country on a knife-edge, hampering

Japanese stocks. In this case, the Japanese yen has a chance to grow

along with the good news that the US stocks seem to perform enduring

consolidation. Eyes should also turn to the rate decision of the Bank of

Japan on September 17, so as to see whether the Bank will greet the new

prime minister with further quantitative easing, which is possible but

not probable from my point of view.

Posted by: wisepowder at

02:32 AM

| No Comments

| Add Comment

Post contains 406 words, total size 3 kb.

​Gold Price Rebounds with Stability Expected at High

From the

start of the week, gold price is little changed compared with last week

as it has quickly rallied from the fresh monthly low of $1,907; while

current market trends may keep gold afloat as the crowding behavior in

the US dollar persists in September.To get more news about WikiFX, you can visit wikifx official website.

Gold price may continue to consolidate as global stock markets are

under pressure with the Nasdaq and S&P 500 sitting at a precarious

position. However, the crowding behavior in the greenback may continue

to coincide with the bullish behavior in gold as a bear-flag formation

emerges in the DXY.

The FED seems to persist with the plan of

"achieving an inflation that averages 2% over timeâ€, which may not be

changed before the US election. Gold price is expected to be lifted once

the Chairman Powell raises the FEDs balance sheet back above $7

trillion.

According to the IG Client Sentiment report, retail investors all

hold net-long USD/CHF, USD/CAD and USD/JPY while remaining net-short

AUD/USD, GBP/USD, EUR/USD and NZD/USD.

Gold price may continue to

consolidate before a successful attempt of closing below $1,907-1,920.

Only when a break/close above $2,016-2,025 appears can the record high

price ($2075) finds its way. The next area of focus comes around $2,064

followed by $2,092.

All the above is provided by WikiFX, a

platform world-renowned for foreign exchange information. For details,

please download the WikiFX App: bit.ly/WIKIFX

Posted by: wisepowder at

02:21 AM

| No Comments

| Add Comment

Post contains 255 words, total size 2 kb.

MFs have many options to meet 25% limit requirement on multi-cap schemes

Market

regulator Sebi on Sunday said mutual funds (MFs) have many options to

meet with the requirement of 25 per cent limits on multi-cap schemes

based on the preference of their unitholders.To get more news about WikiFX, you can visit wikifx official website.

Apart from rebalancing their portfolio in the multi-cap schemes,

mutual funds could facilitate switch to other schemes by unitholders,

merge their multi-cap scheme with their large-cap scheme or convert

their multi-cap scheme to another scheme category (for instance

large-cum-mid cap scheme), the Securities and Exchange Board of India

(Sebi) said in a clarification.

The capital markets regulator, in a

circular issued on Friday, specified that minimum investment in equity

and equity related instruments of large-, mid- and small-cap companies

should be minimum 25 per cent each of total assets.

"Sebi is conscious of market stability and therefore has given time

to the mutual funds till January 31, 2021 to achieve compliance with the

circular, through its preferred route of which rebalancing of the

portfolio is only one such route,†the circular stated.

Posted by: wisepowder at

02:12 AM

| No Comments

| Add Comment

Post contains 199 words, total size 2 kb.

Most Architectural Firms prefer to outsource 3D Architectural Visualization to outside agencies, as they can present their projects in the best possible light. Sketches or 2D drawings are not accurate enough and also do not offer clarity to those who do not have a technical background. However, 3D images leave nothing to the imagination and give every detail of what the proposed project will look like when finished. With CGI, clients can envision projects that have not yet been built. It offers many advantages to architects, including smoother communication and streamlined workflows, which reduces time and expenditure on the project.To get more news about design rendering services, you can visit https://www.madpainter.net official website.

When a project is still under construction, it can be hard to find visual materials for presenting to clients and stakeholders. Professional photoshoots can be done only after the project is finished, and if prospective customers want to see a portfolio before that, then 3D visualization is the way to go. Using CGI you can create a gallery of images that showcase your experience, client list, and innovative design solutions. Clients who are able to view this portfolio will understand the design capabilities of the architect and can get the required mutual understanding with the architect.

The same 3D images can be used as an effective marketing tool.

Potential clients are more likely to buy into the project if they are

able to get a clear understanding of the spaces. These images can be

used in print, on banners, and on social media to advertise the project.

#1. Highlight the Strengths of your Project

3D rendered images show all the features of the design as they have been conceptualized, to the appropriate scale and with details of texture, finishes, material, and color. Potential customers will be able to thoroughly examine all details of the project, including spatial relationships between rooms and different floors, the position of door and window openings, arches and columns, treatment of facades, and so on.

The images can be created with or without the surroundings, as per your requirements. If the neighborhood is also shown, you can get a good idea of how the building harmonizes with its surroundings, and how the entire built environment will look. If the image is created on a blank background, then all the design features of the project can clearly be highlighted. This style of rendering is very professional and is ideal for presenting your project to clients and stakeholders to garner acceptance and approval.

#2. Showcase your Projects in the Context of the Surroundings

With the help of 3D Rendering for Architects, Architects can present the building in the context of the built environment. All the buildings around can be recreated in photorealistic quality, showing how the building sits within its surroundings. The roads around the building, landscaping, and parking can be shown to prospective clients to help them understand spatial flows much better.

#3. Get an Understanding of Exterior Lighting Possibilities

The exterior lighting forms a very important part of the design conceptualization and can make or break the aesthetics and functionality of the project. The perception of the building design depends a great deal on the colors used, temperature and brightness of light, angle of the light rays, shadows cast, different shapes of lighting fixtures, and their placement. The lighting of the garden and landscaping elements will add to the overall appearance of the project. Properly designed illumination of driveways, paths, and stairways is important for the safety of residents of the building.

2D drawings are not adequate to convey the right picture of how the lighting has been conceptualized. Rather than trying to describe a complex lighting system verbally, a picture is worth a thousand words. Clients and investors can easily understand the proposed placement and style of lights in and around the building. Photorealistic images can beautifully showcase the various styles of lighting, including tiny LED strips that add a glow around the ceiling, garden lights that highlight plants and trees, ceiling lights that provide ambient lighting and focus lights that can dramatically change the mood of an interior.

Posted by: wisepowder at

01:58 AM

| No Comments

| Add Comment

Post contains 692 words, total size 5 kb.

September 15, 2020

Chance for USD/GBP/AUD Upside as JPY Strength Limited

Japanese

firms slashed spending on plant and equipment by the most in a decade in

the second quarter, the government said on Tuesday. As a result, the

strength of the Yen was limited while the USD/JPY staged a flat

performance and consolidated around 105.70.To get more news about WikiFX, you can visit wikifx official website.

"Abenomics†is much more likely to see an end ahead of the news that

Abe suddenly resigned his post, which put a premium on the Yen at once

but later revealed to be unrealistic for markets. As the core of

Abenomics, the Yens depreciation pushes domestic prices up and stimulate

the production of companies.

However, Japan's second-quarter

Capex falls most in decade, as reported on Tuesday. In addition, the

strength of JPY will be limited considering other challenges ahead of

Japan such as shrinking workforces and the indefinite postponement of

Olympic Games.

In terms of USD/JPY, the rate is expected to see a further growth

once finding the stability above the level of 104.00 in view of the

strong support ever achieved around the level.

In terms of

EUR/JPY, the rate is now stay in the ascending channel but may hit the

resistance zone of 129.0-130.0 in future tradings if the support is

continuously gained at the lower band of 125.0.

The exchange rate

of AUD/JPY shows a more complex picture. Its short-term uptrend is

expected to suffer a setback as it is currently approaching the

resistance level of 78.60. While in the medium term, gains will be

extended in future tradings if it stays constructive below the 76.60

level.

All the above is provided by WikiFX, a platform

world-renowned for foreign exchange information. For details, please

download the WikiFX App: bit.ly/WIKIFX

Posted by: wisepowder at

07:27 AM

| No Comments

| Add Comment

Post contains 303 words, total size 3 kb.

32 queries taking 0.0457 seconds, 97 records returned.

Powered by Minx 1.1.6c-pink.