October 19, 2020

Africa's most advanced economy is talking to the International Monetary Fund (IMF), World Bank, New Development Bank of the BRICS and African Development Bank to source funding to contribute to a 500 billion rand rescue package aimed at cushioning the impact of the new coronavirus on businesses and poor households.

The IMF has said South Africa is entitled to apply for up to $4.2 billion in response to the crisis, and Finance Minister Tito Mboweni said on Friday the government could negotiate for a facility of "maybe between $55 and $60 million†at the World Bank.

Dondo Mogajane, director general of the National Treasury, said in an interview with eNCA television on Sunday that South Africa "will certainly go†for the IMF funding.

"The World Bank has said ...South Africa can access a loan of about $50 million, the New Development Bank did say long ago that they have set aside a billion dollars that we can access and again we will be accessing that,†Mogajane said.

"All in all, all of these interventions, currently we are looking at 95 billion rand coming from these institutions only for COVID-related interventions.â€

Mogajane said the government has to do everything at its disposal to make sure the coronavirus is contained, including reprioritising money from projects that are not a priority for now and looking for new cheap money.

"I am emphasising new money that is cheap because currently the discussions obviously should centre around what the term rates are going to be. That is where we are currently, we are discussing with them (lenders),†he said.

"The IMF has said upfront that it is 1% interest that is available so we will certainly go for it because it is cheap.â€

Mboweni on Friday played down worries in some governing party circles and within the influential trade union movement that the money would come with onerous conditions.

An IMF official told Reuters that the emergency funds on offer came with no requirement for a structural adjustment programme.

The economy was in recession when the virus outbreak hit South Africa and public finances were already strained as the government bailed out struggling state firms.

South Africa had recorded 4,361 cases, including 86 deaths, with 161,004 people tested for the virus as of Saturday.

Posted by: wisepowder at

08:39 AM

| No Comments

| Add Comment

Post contains 427 words, total size 3 kb.

While the country's borders have been closed since March, the new decree goes further in preventing until Sept. 1 the sale and purchase of commercial flights to, from or within Argentina.To get more news about WikiFX, you can visit wikifx official website.

The spread of coronavirus "does not allow certainties†for the end of social isolation measures, which would threaten commercial air transportation, the decree said.

"It has been understood to be reasonable to set September 1, 2020 for the purpose of rescheduling regular operations or requesting authorizations for non-regular operations of passenger air transport subject to the effective lifting of restrictions imposed on commercial air transport and operating modalities,†the decree by the National Civil Aviation Administration said.

Part of the decree's aim is to prevent airlines from ticketing flights not approved by the government.

"The problem was that airlines were selling tickets without having authorization to travel to Argentine soil,†a spokesman for President Alberto Fernandez said.

The decision prompted industry groups including ALTA, which lobbies on behalf of Latin American airlines, to warn that the decree represented "imminent and substantial risk†to thousands of jobs in Argentina.

"It is our responsibility to express the deep concern generated by the resolution in question, which was not shared or agreed with the industry and, furthermore, runs counter to the efforts of all the actors in the sector to propose and implement a plan for responsible and safe reactivation that re-establishes commercial activities and an essential service for the population,†the groups said in a statement.

The presidential spokesman, however, said the decision resulted from a "consensus between the government and the airline sector.â€

The Sept. 1 timeframe was arranged with the airlines "to give time to our authorities to bring all the Argentines who are abroad and want to get back,†the spokesman said.

The South American nation had already closed its borders and blocked entry to foreigners from "affected zones,†including Europe, China and the United States.

Argentina has been under a national lockdown since March 20. The government, over the weekend, extended the quarantine until May 10, but said it had been successful in slowing the rate at which new cases double.

Posted by: wisepowder at

08:33 AM

| No Comments

| Add Comment

Post contains 407 words, total size 3 kb.

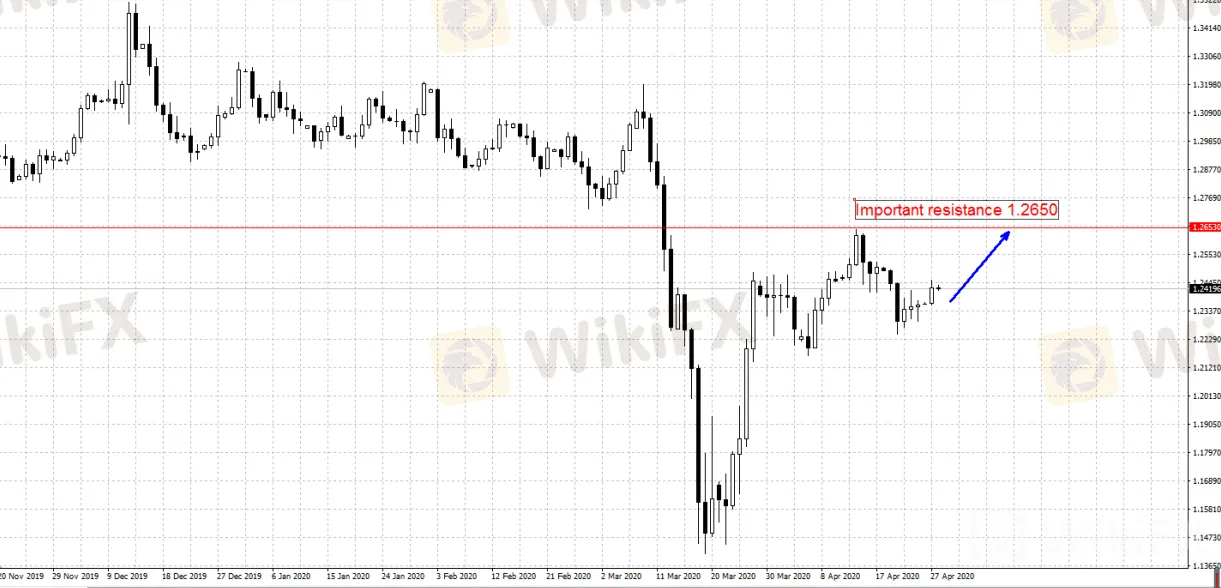

Despite Markit's service industry PMI in April of 12.3, which was much lower than the expected 27.8, the pound did not show a sharp decline, indicating that the market partially digested the epidemic's shock on Britain's economy. We believe that pound s current exchange rate at an extremely low range indicates the currency has little room for further declines. As the global economy gradually recovers, the pound may rebound significantly.

The negotiators of the United Kingdom and the European Union began week-long consultations to discuss the relationship between the two countries after the Brexit, including trade issues. As the epidemic persists, the possibility of the UK applying for an extension of the Brexit transition period is also increasing. The market still needs to pay close attention to how the progress of related matters evolve.

Posted by: wisepowder at

08:25 AM

| No Comments

| Add Comment

Post contains 192 words, total size 2 kb.

TOKYO/NEW YORK (Reuters) - Asian shares and U.S. stock futures dipped into the red on Tuesday, erasing earlier gains as a renewed decline in oil prices overshadowed optimism about the easing of coronavirus-related restrictions seen globally.MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.3%. Shares in China fell 0.7% and South Korean shares fell 0.22%.Oil futures slumped after the largest U.S. oil exchange-traded fund said it would sell all its front-month crude contracts to avoid further losses as prices collapse.Some investors are hoping the worst may be over for the world economy as more countries allow businesses to re-open, but others see reasons to remain cautious, especially as a coronavirus vaccine has yet to be developed.

"We are less optimistic and expect a slower recovery in the world economy,†Commonwealth Bank of Australia said in a research note."The risk of reintroducing restrictions is a risk to market participants' optimistic outlook for a quick resumption of normal economic activity.â€All three major U.S. stock averages advanced on Monday and are all now within 20% of their record closing highs reached in February.The benchmark S&P 500 is on track for its best month since 1987, after trillions of stimulus dollars helped U.S. equities claw back much of the ground lost since the coronavirus crisis brought the economy to a grinding halt.

But some analysts believe gains may be limited unless there is progress in finding treatments for the disease.

From Italy to New Zealand, governments announced the easing of restrictions, while Britain said it was too early to relax them there. New York state is not expected to reopen for weeks..Oil prices weakened again on persistent concerns about oversupply and a lack of storage space. The front-month contract was trading at lower-than-usual volumes on Monday as traders moved to later months in futures contracts.U.S. crude skidded 14.24% to $10.96 a barrel while Brent crude fell 4.05% to $19.18 per barrel.

Shares of United States Oil Fund LP , the country's largest crude ETF, fell more than 16% on Monday, after it said it would sell all of its front-month crude contracts to avoid a repeat of the heavy losses suffered last week.The U.S. dollar and the euro were little changed as traders refrained from taking big positions before a Federal Reserve policy decision due on Wednesday and a European Central Bank (ECB) meeting Thursday.The Fed has already announced a raft of measures to lessen the economic blow from the coronavirus pandemic and is expected to stay on hold this week.The ECB is likely to extend its debt purchases to include junk bonds and provide a backstop for corporate financing.

Major central banks have responded to the economic slump caused by the coronavirus by slashing interest rates, buying more government debt, and taking steps to increase lending to small companies.Elsewhere in currencies, the Australian dollar traded near a six-week high of $0.6472 as investors continued to cheer the country's progress in containing the coronavirus.Gold, a safe-haven often bought during times of uncertainty, fell for a third consecutive trading session in signs of improving risk appetite.(Reporting by Stanley White in Tokyo and Chibuike Oguh in New York; Editing by Sam Holmes)

Posted by: wisepowder at

08:15 AM

| No Comments

| Add Comment

Post contains 650 words, total size 4 kb.

"We saw that the number matched, and we checked again," Schuman told Virginia Lottery officials. "It was shocking. ... This isn't what we expected!" Schuman, who picked up his payout on Feb. 20, says he doesn't know what he'll do with the winnings yet. The 7-Eleven, meanwhile, got $10,000 for selling the ticket. WUSA 9 notes that Virginia had another recent holiday winner: A man who purchased a lottery ticket in Manassas on St. Valentine's Day won $10 million.

Posted by: wisepowder at

07:33 AM

| No Comments

| Add Comment

Post contains 198 words, total size 1 kb.

"She did all of this like it was second nature to her,†said Lee, who described her cousin as a generous, loving and adventurous woman who enjoyed hiking and bicycle rides. Graham is survived by her mother, Latrinda Graham, and a 10-year-old sister, Zoey. Lee said Graham and her younger sister had an "unbreakable bond." "We are hurting. We are in pain,†Lee said. "Our family is devastated.†Hill won $10 million from an Ultimate Millions scratch-off ticket in August 2017, WECT-TV reports. Hill was arrested Tuesday in Southport, NC. He was ordered held without bond at a Brunswick County jail after his initial court appearance.

Posted by: wisepowder at

07:14 AM

| No Comments

| Add Comment

Post contains 233 words, total size 2 kb.

Alex Prunty won $75,000 off a Break Fort Knox scratch-off ticket. A regular scratch-off player, he said he picked that one because the purple and gold caught his eye.

Prunty said he typically plays with his wife, and his mother and was with them when he won big.

"I scratched my numbers off first. I always scratch for big zeros," he said. "We saw them and we screamed. Then my mom scratched the number beside it. We had to calm down."A father of four, Prunty hit the jackpot before his family left on vacation to Gatlinburg, Tennessee. Needless to say, that trip is now paid off.

Posted by: wisepowder at

07:07 AM

| No Comments

| Add Comment

Post contains 144 words, total size 1 kb.

John Dolan, 67, bought the $10 scratch-ff ticket at a Publix on South Tamiami Trail in Bonita Springs. The retailer will receive a $4,000 bonus commission for selling the winning scratch-off ticket.

The $10 MONOPOLY BONUS SPECTACULAR game features more than $162 million in cash prizes, including four top prizes of $2 million, according to the Florida Lottery.

Posted by: wisepowder at

07:01 AM

| No Comments

| Add Comment

Post contains 97 words, total size 1 kb.

The Hoosier Lottery is encouraging Region residents to check their pockets, their purses, under their couch cushions, and anywhere else they might keep their lottery tickets to see if they are the winner.

According to lottery officials, the winning ticket was purchased for the May 9 Powerball drawing at Speedway, 6845 Calumet Ave.

It matched four of the five white balls and the red Powerball to win the game's third-highest prize.

The winning numbers for the May 9 drawing were 12, 18, 42, 48, 65 and Powerball 19.

Lottery rules require all draw game prizes be claimed within 180 days of the drawing. Otherwise, the prize is forfeited and the money remains in the lottery's prize fund to pay future jackpots won by Hoosier Lottery players.

A person holding the winning ticket should sign and complete the information on the back of the ticket.

Due to the coronavirus pandemic, the winner must schedule an appointment by calling 800-955-6886 prior to bringing the ticket by Nov. 5 to Hoosier Lottery headquarters, 1302 N. Meridian St., Indianapolis, to claim the prize.

Posted by: wisepowder at

06:55 AM

| No Comments

| Add Comment

Post contains 221 words, total size 2 kb.

Geekvape in the last 3 years have become best known for their Zeus atomizers and Aegis devices and here we have them meet in the form of coil cross compatibility. The Zeus Nano Tank borrows it's top to bottom airflow system from it's bigger brother the Zeus Sub-ohm tank just on a smaller scale offering a more restrictive vape for lower wattage RDL or loose MTL dependant on airflow setting and installed coil head. The coils get press fitted into the chamber and the top to bottom airflow offers a leak resistant solution.To get more news about Geekvape zeus nano, you can visit urvapin official website.

The Zeus Nano Tank accommodates the G Boost B-series coil heads that are used by the Aegis boost and this cross compatibility of coil heads is something that's both welcomed and we should see more of. Coming in 6 different colour options and with familiar Zeus aesthetics let's give the 22mm in diameter new member of the Zeus family a closer look! The Zeus Nano Tank came in cardboard box sample packaging so the retail packaging will differ. I received the Rainbow colour version, the options are Silver, Gunmetal, Blue, Black, Gold or Rainbow. The build quality and overall look is the same as we have seen with previous Zeus family members with the Nano at 22mm being the most slender of the siblings which also gives it a taller look. Up top we have a Black 510 Delrin drip tip then a top-cap that tapers and has spaced indented grooves for a good grip.

The base section has the same indented grooves and is 22mm at the very base and then it tapers outwards then back inwards making the straight glass approximately 23mm wide. Below the top-cap we have the airflow control ring with short dual airflow slots and "ZEUS" carved into the metal. Looking through the glass at the visible chamber we can see cut-out sections either side that line up with the coils wicking ports and the familiar Zeus logo on both the front and back. Moving to the base we have a Gold plated 510 pin, branding and safety marks!

Posted by: wisepowder at

06:41 AM

| No Comments

| Add Comment

Post contains 364 words, total size 2 kb.

Chuck Norris references. Anal jokes. Killing two dozen raptors to harvest ten raptor heads. The Barrens. Shit, after two hours of the World of Warcraft Classic demo, I’m still in the Barrens. It’s an inescapable nightmare, which is to say it’s perfect. To get more news about cheap WoW items, you can visit lootwowgold official website.

We wanted it hard, and Blizzard is giving it to us hard. The development team has been working furiously since even before last year’s official announcement of the retro version of the MMORPG, cramming old code into a newer framework in order to undo all the streamlining and simplification they’ve done since 2005. So far, so good. The WoW Classic demo, available for visitors to Blizzcon 2018 and those who purchased the virtual pass for the event, takes players back to 13 years ago, when Molten Core and Onyxia were the raids to beat. But demo players aren’t going on those grand adventures.No, the demo starts players off at level 15, with Horde and Alliance players sent to the limbo of their side’s choosing.

For the Alliance, that’s the golden fields of Westfall, filled with coyotes, vultures, boars, bandits and gnolls. The mighty fortress of Sentinel Hill? Not so mighty anymore. From the starting area, players can accept quests incredibly slowly. Remember, back then the quest text used to crawl down the page before the accept button would light up. You can go into the game’s options and change it, but what about authenticity? It’s only 15 seconds out of your life every time a quest giver is clicked on.

Once quests are accepted, it’s off to ... um. Huh. See, back then there wasn’t really a quest tracker. Players didn’t get dots or arrows on their map, showing them where their objectives were. And considering the landscape of Westfall changed significantly when the Cataclysm expansion dropped, most everybody on my beta server was just wandering about hopelessly. It was horrible, but also beautiful. Wandering the countryside, searching for bandits, not knowing what I was going to run into—that’s the World of Warcraft that drew me in so many years ago. And when I, only my second Alliance rogue of the demo, finally found the bandits I was supposed to kill, I felt like I had really accomplished something.

Posted by: wisepowder at

06:30 AM

| Comments (1)

| Add Comment

Post contains 395 words, total size 3 kb.

After World of Warcraft first launched on November 23, 2004, it took players 69 days to defeat the endgame raid boss Onyxia. The ten bosses of the Molten Core raid weren’t completely conquered until April 25, 2005. It only took European guild APES six days to accomplish both feats in the newly-launched World of Warcraft Classic.To get more news about best place to buy wow classic gold, you can visit lootwowgold official website.

APES did not have the world’s first level-60 character in Classic. That milestone was reached by gnome mage Jokered on August 30. But the European powerhouse did manage to assemble a full raid group in time to take down the game’s first two 40-man raids on September 1.I consider getting a team of 40 characters of raiding level together to be APES’ finest achievement. Taking down Onyxia and Molten Core takes some doing, but players have had a decade and a half of practice.

It’s not like back in 2005, when everyone was figuring out mechanics and strategies for all of the boss fights while simultaneously learning how to work efficiently together. The main obstacle this time around was getting there, and APES got there first. Meanwhile, I’m taking my time in WoW Classic nice and slow. I’ve set up shop as a human mage named Grann on the role-playing player-versus-player server of Deviate Delight. Seven days since launch, I am only level 21, with no plans to go on a leveling binge any time soon. I played during launch, so I know what to expect at level 60 and am in no rush. I’m enjoying wandering around Westfall, randomly chatting in-character with other players.

I’ve taken to sitting on the fountain in the middle of Moonbrook, telling people who pass by that the statue atop it is of my character’s father. I tell them the nearby dungeon, the Deadmines, was named after him, and originally called the Dadmines. It’s not a very good joke, but it makes me happy. Congratulations to the players who rushed through to the end. Hopefully now they can take some time to relax and enjoy World of Warcraft Classic’s blossoming community, its biggest achievement so far.

Posted by: wisepowder at

06:19 AM

| No Comments

| Add Comment

Post contains 377 words, total size 2 kb.

Once every month or two, I have this dream. I’m standing in a cavernous entryway to what my brain tells me is absolutely a World of Warcraft raid dungeon. Its walls are streaked with throbbing orange and purple veins, akin to the armor sets dropped in Molten Core, an actual WoW raid dungeon. It is dark. It is strangely cold. I am supremely under-leveled. And I am alone.To get more news about buy wow gold classic, you can visit lootwowgold official website.

I wake up from this dream with my heart pounding and an almost painful clenched feeling in my chest. It’s my version of the nightmare where you’re back in high school or college, and you realize you’re seconds away from taking a test you haven’t studied for in a class you never attended. This makes sense: From 2005-2007, toward the end of my time in high school, World of Warcraft was as formative for me as any class, probably more so. For a solid two years, it was part of my day, every day. I’d get home from school and Taekwondo in the evening, and then I’d level or—later, once I’d joined a serious guild and gotten In Too Deep—raid for anywhere between four and six hours. But a few months after the game’s first expansion, Burning Crusade, came out in 2007, I burned out and stopped playing.

I’ve popped in again at various points over the years, but my returns were never habit-forming. I’d poke around for a few days, realize the game wasn’t for me anymore, and move on. Until now. For the past couple months, I’ve been semi-regularly dipping into WoW Classic with a small group of friends. I’m playing a troll rogue named Trollthan. He has a pink mohawk. He likes to dance. It’s been nice, even if, as an adult, it’s impossible to ignore the fact that WoW’s trolls are just thinly-veiled Jamaican stereotypes. Because WoW Classic is an official imitation of pre-expansion WoW, I’m back where it all began. But even if the game is the same, I’m not. My motivation for continuing to play has shifted monumentally. Where once I was driven by loot and lore, now it’s all about people. When I first started playing WoW, I was a quiet kid, and a pretty lonely one to boot. Some upperclassmen I looked up to—the cool nerds—got into Blizzard’s MMO soon-to-be-sensation shortly after it came out in 2004, and they told me I should roll a Horde character on their server, Thunderlord, and join them. So I did. Maybe I’d become friends with them.

Unfortunately, my Tauren shaman never met up with their edgy in-game avatars; I was too anxious to admit that I was interested in playing WoW with people I barely knew and that I’d gone through all the necessary steps to make it happen (Note to past me: intensely counterproductive thinking there, buddy!). Ultimately, they didn’t stick with it for long.

Posted by: wisepowder at

06:06 AM

| No Comments

| Add Comment

Post contains 502 words, total size 3 kb.

QS Quacquarelli Symonds, a global higher- and business-education analyst, just released its 2021 Global MBA Ranking.To get more news about Best MBA program in China, you can visit acem.sjtu.edu.cn

official website. To find the best MBA programs, QS used five key metrics to develop an overall index: employability, entrepreneurship and alumni outcomes, return on investment, thought leadership, and class and faculty diversity. "In addition to analyzing program-related inputs, QS also considered the reputation of specific business schools from the perspective of nearly 37,000 global employers and more than 34,000 global academics," Dr. Andrew MacFarlane, the rankings manager at QS, said about the latest world rankings. "Finally, we mapped the education paths of 27,831 successful alumni back to specific institutions." Interest in recruiting business school graduates has picked up again after falling amid uncertainty earlier in the pandemic, according to a Graduate Management

Admission Council survey in September.Stanford Graduate School of Business ranked at the top again, while the University of Pennsylvania's Wharton School dropped to second place after tying for first in last year's ranking. Read on to find out the top 50 global MBA programs, along with typical costs and the average salary earned three months after graduating. The full list and other rankings, such as programs specializing in finance or supply chain management, can be found on QS' TopMBA website.

Posted by: wisepowder at

05:56 AM

| No Comments

| Add Comment

Post contains 229 words, total size 2 kb.

In spring 2019, University President Mark R. Nemec, PhD and Fairfield Dolan School Dean Zhan Li, DBA traveled to China. Their mission: to expand the University’s footprint and raise international brand awareness of Fairfield University.To get more news about Shanghai mba, you can visit acem.sjtu.edu.cn official website.

"The result of that trip is our partnership with Golden Education, which allows us to provide a high-quality MBA program to professional students,†said Dean Li. "Offering high-quality education on the global scale has been a vision of the Jesuits, a vision that is almost 500 years old. Our MBA in Shanghai amplifies that vision.†Golden Education is one of the largest management training companies in China. A degree from a U.S. institution is highly regarded in China, but not all students have the time or money to go abroad, explained Dean Li. The Fairfield MBA program in Shanghai, led by Fairfield professors, allows students to continue in their professional careers while pursuing the degree in the evenings and weekends.

While the program has a focus on finance, students will also take the same marketing, management, and leadership classes that Fairfield MBA students take. The Shanghai students are scheduled to take the final class in the program – the Wall Street Immersion course – on campus in fall 2021. The Shanghai MBA program began with a cohort of 35 students in September 2020. "The launch of this program is a tremendous accomplishment for the Dolan School of Business, and we’re particularly excited about the variety of backgrounds students represent, from finance to engineering and law,†said John McDermott, PhD, chair of the Finance Department at Dolan School.

One of the benefits of attending graduate school is the opportunity to develop a network, and having an accomplished, competitive cohort working together will foster that network. That’s important for students as well as for Fairfield. "We’re creating a brand for ourselves in Shanghai,†said Leanne De Los Santos, assistant dean of graduate programs at the Dolan School, who interviewed each of the applicants. "These high-caliber students are all professionals, and many work at big companies. Their success is our success, as they will refer others to the program.â€

Posted by: wisepowder at

05:48 AM

| No Comments

| Add Comment

Post contains 369 words, total size 3 kb.

After taking a hit in the first two quarters due to the COVID-19 outbreak, China's economy is expected to see a recovery this year, an International Monetary Fund (IMF) official has said.To get more economy news today, you can visit shine news official website.

According to IMF report, China's economy is expected to grow 1.9 percent this year, almost twice as much as previously forecast. IMF tagged the superpower as the only major nation likely to expand in the face of the coronavirus. However, it warned that with other countries and crucial markets still struggling to overcome the pandemic, the road ahead remained bumpy, while a standoff with the US on various issues posed a threat to the global recovery.In an update to its World Economic Outlook on Tuesday, the IMF said it now sees annual growth of 1.9 percent, compared with its earlier prediction of one percent in June.

China's exports have "recovered from deep declines earlier in the year, supported by an earlier restart of activity", the IMF report said.A "strong pickup in external demand for medical equipment and for equipment to support the shift to remote working", also boosted exports. Chinese customs authorities on Tuesday said exports jumped 9.9 percent on-year in September, initially spurred by worldwide demand for Made-In-China personal protective equipment but now widening to household appliances and plastics. China is the only major economy with a positive growth forecast for this year, according to the Fund. "While recovery in China has been faster than expected, the global economy's long ascent back to pre-pandemic levels of activity remains prone to setbacks," the IMF said. The body warned that the world faced a "long, hard, dire" path to post-pandemic recovery and slashed its annual forecasts further, predicting the global economy would shrink 5.2 percent, compared with a 4.9 percent contraction predicted in June. The prolonged US-China trade war that has tipped into a bitter battle for global tech supremacy also threatened to undermine global recovery, IMF said. As part of a partial trade truce signed in January, Beijing promised to import an additional $200 billion in American products over two years, ranging from cars to machinery and oil to farm products.

But the pandemic has put pressure on the agreement and China's purchases of those goods has been lagging. The IMF warned that "tensions between the world’s two largest economies remain elevated on numerous fronts" as Beijing and Washington also lock horns over China's treatment of ethnic minorities in Xinjiang and Beijing's security clampdown in Hong Kong. China is still battling localised coronavirus outbreaks, but has largely curbed its spread, allowing most businesses including cinemas and hotels to reopen and domestic tourists to travel.

Posted by: wisepowder at

05:40 AM

| No Comments

| Add Comment

Post contains 456 words, total size 3 kb.

The novel coronavirus pandemic has unleashed an immense shock to the global economy. In Europe, the gross domestic product among the countries that use the euro has dropped by over 12 percent while unemployment rates have risen to nearly 8 percent. Many countries are unlikely to reach pre-pandemic levels of gross domestic product until 2022 or later.To get more Shanghai economy news, you can visit shine news official website.

China may take advantage of the crisis — just as it did in the wake of the global financial crisis of 2007 to 2008 — to advance its geopolitical and economic interests in Europe. While the European Union put together a 750 million euros ($878 million) pandemic recovery package this July — demonstrating more advanced crisis management capabilities than it has during past Eurozone crises — the continent is still struggling. Beijing may use its sovereign wealth fund as well as nominally private Chinese companies to act as lenders of last resort in Europe, building Beijing’s soft power at Washington’s expense.

Given China’s assertive turn in its foreign policy, it may use this influence to splinter Western solidarity on issues like Taiwan, Hong Kong, and the South China Sea. Additionally, China is likely to use its economic statecraft to acquire sensitive dual-use technologies through the purchase of AI or robotics firms, and purchase infrastructure that is important to U.S. and allied military forces operating in or through Europe. To be clear, much of the Chinese-origin foreign direct investment in Europe is not of national security concern. By one estimate though, as much as half of China’s foreign direct investment in Europe could be considered to pose a security risk. Whether Europe is prepared and able to parry Beijing’s moves is somewhat unclear, given varied attitudes toward China and the patchwork of investment screening mechanisms across the continent. Regardless, the outcomes will have significant implications for U.S. security. In the wake of the global financial crisis over a decade ago, Chinese investment in Europe exploded.

In 2008, Chinese outward foreign direct investment in Europe was valued at just 700 million euros — by 2016, that amount had grown to 37.3 billion euros. These investments brought much needed capital to the cash-strapped continent. Chinese investors — both public and private — were drawn to Europe for several reasons, including the undervaluation of European assets and the friendlier investment climate relative to the United States. Chinese investments were mostly concentrated in a few key countries, with the United Kingdom (30 percent), France (18 percent), Germany (13 percent), and Italy (11 percent) receiving the lion’s share. Most of these investments were made by Chinese state-owned enterprises or its sovereign wealth fund, which are directly tied to the central government and hence to the Chinese Communist Party. Ostensibly, private Chinese firms have increasingly invested in Europe as well, but China’s 2017 national security law effectively blurred the line between private entities and the Chinese state.

There is some evidence that China’s investment boom in Europe paid geopolitical dividends. Beijing might now again take advantage of Europe’s economic position in the aftermath of the novel coronavirus to build soft power, obtain sensitive technologies, or acquire militarily significant infrastructure. The question confronting Europe, as well as the United States, is whether it is prepared to respond any differently to Beijing’s use of economic statecraft than it did in the wake of the last economic crisis.

Posted by: wisepowder at

05:29 AM

| No Comments

| Add Comment

Post contains 575 words, total size 4 kb.

Shanghai increased airport screening on Saturday as imported coronavirus infections from countries such as Italy and Iran emerge as the biggest source of new cases in China outside Hubei, the province where the outbreak originated.To get more latest Shanghai news, you can visit shine news official website.

Mainland China had 99 new confirmed cases on Friday, according to official data. Of the 25 that were outside Hubei, 24 came from outside China. Shanghai, which had three new cases that originated from abroad on Friday, said it would step up control measures at the border, which had become "the main battlefieldâ€.At a news conference, Shanghai Customs officials said they city would check all passengers from seriously affected countries for the virus, among other airport measures. Shanghai already requires passengers flying in from such countries, regardless of nationality, to be quarantined for 14 days. They will now be escorted home in vehicles provided by the government. Tighter screening has greatly lengthened waiting times at Shanghai’s Pudong International Airport - some passengers say they have had to wait as long as seven hours.The Shanghai government vowed on Saturday to severely punish passengers who concealed infections.

Beijing police said on Saturday they would work with other departments to prevent imported infections. They said some members of a Chinese family flying in from Italy on March 4 had failed to fill in health declarations accurately, and later tested positive for the virus. In addition to the growing risk of imported infections, China faces a challenge in trying to get migrant workers back to work by early April. So far, 78 million migrant workers, or 60% of those who left for the Lunar New Year holiday in January, have returned to work. Yang Wenzhuang of the National Health Commission (NHC) said that the "risk of contagion from increased population flows and gathering is increasing ... We must not relax or lower the bar for virus controlâ€. But new cases in mainland China continued to decline, with just 99 new cases on Friday, the lowest number the NHC started publishing nationwide figures on Jan. 20, against 143 on Thursday.

Most of these cases, which include infections of Chinese nationals who caught the virus abroad, were in the northwesterly Gansu province, among quarantined passengers who flew into the provincial capital Lanzhou from Iran between March 2 and 5. For the second day in a row, there were no new infections in Hubei outside the provincial capital Wuhan, where new cases fell to the lowest level since Jan. 25.The total number of confirmed cases in mainland China so far is 80,651, with 3,070 deaths, up by 28 from Thursday.

Posted by: wisepowder at

05:14 AM

| No Comments

| Add Comment

Post contains 451 words, total size 3 kb.

October 12, 2020

Bank of England Is Assessing Negative Rate Policy

May 25th from

WikiFX News. Bank of England Governor Andrew Bailey change his comment

last week that negative rate "is not an approach we‘re considering or

planning to take†and said it’s the right time to review and assess all

policy tools, indicating that the Bank of England is urgently evaluating

the possibility of introducing negative rate.To get more news about WikiFX, you can visit wikifx official website.

Giving the green light to negative rate doesnt mean the central bank

will immediately adopt a rate below zero. What the central bank is doing

right now is planning for the next step after a potential shock in the

future, and the pandemic accelerated the process. Currently the central

bank is relying on QE as the main stimulus approach, the government has a

rising demand for borrowing, and a risk of further shrinking economy

also confirms the need for easing policies.

With the government launching unprecedented measures to prevent

possible economic breakdown due to the pandemic, Britain‘s budget

deficit in April climbed to an unprecedented high since the modern

record was established in 1993, with central government spending surging

57% and income falling 27%. Even during the financial crisis, Britain’s

monthly borrowing had never exceeded 22 billion pounds.

Posted by: wisepowder at

04:59 PM

| No Comments

| Add Comment

Post contains 222 words, total size 2 kb.

WikiFX Visited Forex Broker xtrade in Australia

Regulatory

information shows that trader xtrade's Australian office is located at

‘St Kilda Road Towers’, 1 Queens Road, MELBOURNE VIC 3004.To get more

news about WikiFX, you can visit wikifx official website.

WikiFX survey team learned that ‘St Kilda Road Towers’ at Queens Road

1 is a 15-story business complex located in one of Melbourne's most

prestigious commercial zones. It is accessible via all major arterial

roads and a short walk from Melbourne CBD.

We drove to ‘St Kilda Road Towers’, which stood out among the nearby

parks and golf courses. Entering the office building, we found our

destination xtrade on the floor map. After we arrived at xtrade's

office, we had a brief communication with the staff, who welcomed us and

allowed us to film part of their work scene. Most of the company's

staff were busily working at the time. We conclude that the office of

xtrade in Australia truly exists.

Xtrade has more than 10 years of

experience in the industry, providing financial trading services in

stocks, commodities, forex and index CFDs. At xtrade, customer funds are

isolated and protected in reputable credit institutions. Per

investigation, xtrade holds MM license granted by ASIC and is fully

qualified for forex brokerage business.

According to WikiFX App,

the broker xtrade is currently in valid regulation holding MM license

issued by ASIC, Rated at 7.48, xtrade has acceptable credibility. But as

it has received several complaints in the past three months, investors

still need to beware of the risks in choosing the broker.

Posted by: wisepowder at

04:53 PM

| No Comments

| Add Comment

Post contains 267 words, total size 2 kb.

34 queries taking 0.0518 seconds, 99 records returned.

Powered by Minx 1.1.6c-pink.