September 24, 2020

​Gold Price Rebounds with Stability Expected at High

From the

start of the week, gold price is little changed compared with last week

as it has quickly rallied from the fresh monthly low of $1,907; while

current market trends may keep gold afloat as the crowding behavior in

the US dollar persists in September.To get more news about WikiFX, you can visit wikifx official website.

Gold price may continue to consolidate as global stock markets are

under pressure with the Nasdaq and S&P 500 sitting at a precarious

position. However, the crowding behavior in the greenback may continue

to coincide with the bullish behavior in gold as a bear-flag formation

emerges in the DXY.

The FED seems to persist with the plan of

"achieving an inflation that averages 2% over timeâ€, which may not be

changed before the US election. Gold price is expected to be lifted once

the Chairman Powell raises the FEDs balance sheet back above $7

trillion.

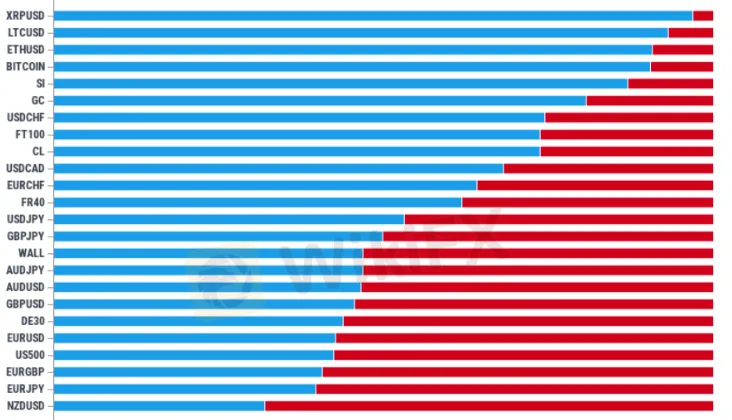

According to the IG Client Sentiment report, retail investors all

hold net-long USD/CHF, USD/CAD and USD/JPY while remaining net-short

AUD/USD, GBP/USD, EUR/USD and NZD/USD.

Gold price may continue to

consolidate before a successful attempt of closing below $1,907-1,920.

Only when a break/close above $2,016-2,025 appears can the record high

price ($2075) finds its way. The next area of focus comes around $2,064

followed by $2,092.

All the above is provided by WikiFX, a

platform world-renowned for foreign exchange information. For details,

please download the WikiFX App: bit.ly/WIKIFX

Posted by: wisepowder at

02:21 AM

| No Comments

| Add Comment

Post contains 255 words, total size 2 kb.

35 queries taking 0.0366 seconds, 63 records returned.

Powered by Minx 1.1.6c-pink.